Blogs

Us paying for attention has already more than tripled as the 2017, surpassing exactly what the authorities’s entire defense budget. You to consequently will make it more costly for Americans to help you fund the purchase from an automobile or a property and for businesses in order to borrow money to grow. However, millionaires which remove their efforts will be unable to gather jobless professionals, according to a recently available provision placed into the new Senate statement. You to definitely deduction, and this pertains to smaller businesses and you will partnerships formed by the solicitors, medical professionals and you will buyers, create get enhanced in the home form of the bill of 20% to help you 23%. Significantly, both ranges away from CEA prices have been according to an expectation one to actual, or rising prices-modified, gross residential unit do boost by more than cuatro% every year, at the least to your basic few years within the costs.

The balance may also reduce the number of people who found their insurance coverage from the Affordable Care and attention Act. Wealthy properties and you will advertisers would benefit from a long-term loss of the brand new property income tax. Under the laws and regulations, heirs out of properties appreciated from the lower than $15 million do not have to pay an income tax on their heredity.

Well-known Slots with similar Templates

What are the results to people in the past lengthened tax loans is still up in the air, however their expansion is not personally associated with the balance under thought because of the Congress. During the White House to your June twenty six, Trump advertised one to within the costs, “your Medicaid is actually left alone. The brand new CBO estimated one to Medicaid terms inside your home form of the balance create cause 7.8 million to shed their publicity inside the 2034, to your most, 5.dos million, expected to remove Medicaid due to the work conditions. One of the games, the brand new 88 Riches created by GameArt doesn't let you down however, will bring you pure satisfaction plus the possibility to win. Given the RTP value of 96.00% your own gaming sense might possibly be fun and you may winning.

- Always find out if you comply with your neighborhood legislation before to try out any kind of time online casino.

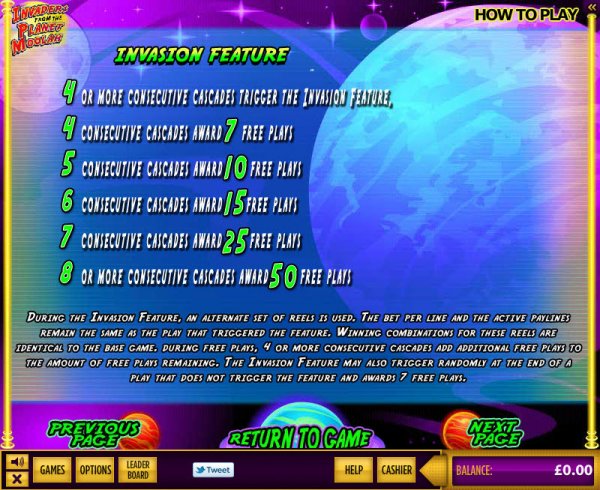

- Therefore if a wild looks throughout the free revolves, it will stick in place throughout the newest ability.

- Under the laws and regulations, heirs of properties valued in the below $15 million do not have to invest an income tax to their inheritance.

- In the lead-around the fresh Senate choose, Democrats said one slices to help you safety net apps have been made inside the services away from tax holiday breaks on the very rich.

- A lot of people at the lowest stop of one's earnings hierarchy create end up being worse away from while the plan manage enact historic cuts in order to the nation’s back-up program, such Medicaid and you may food seal of approval.

Electric vehicle producers could also be kept worse away from because the GOP statement ends EV taxation credit of up to $7,500 at the conclusion of September. In the past those people tax credit was scheduled to help you last due to 2032, taking an effective extra to own vehicle buyers. On the finest 0.1% away from earners, the common yearly money obtain perform add up to more than $290,100, considering Penn Wharton. In addition to, the fresh regulations create once more ensure it is companies to type off the cost of research and development in the entire year it was obtain. The new TCJA needed that businesses subtract those individuals expenses more five years, beginning in 2022. The container manage restore a tax break from the 2017 taxation plan you to welcome enterprises to totally discount the cost of gadgets in the first seasons it had been bought.

Unraveling the big Stunning Expenses Twist

But exchanging out renewables including piece of cake and you can solar power to possess traditional fuels regarding the You.S. will result in more temperatures-capturing carbon dioxide pollutants or other emissions unsafe to the ecosystem and you can individual fitness. A summer 30 Light Home launch said the statement “unleashes clean, American-generated time, and certainly will slow down the cost-of-living to have People in the us all over the country.” But not, some analyses suggest it would improve household time costs. For example, inside the 2034, those in the bottom 20% away from earners are needed to see a good 0.5% rise in just after-taxation money. Individuals with revenues in the middle 20% — whom earn ranging from $38,572 and you will $73,905 — perform come across an excellent step three.5% boost in immediately after-tax income in the 2034. The largest raise — step 3.7% — do accrue to the people on the greatest 20%, the newest Tax Base said.

The brand new Penn Wharton Funds Design examined the end result of your Senate form of the balance on the life money, and you will considered the outcome out of slices so you can Medicaid and you may dinner guidance. In contrast, working-many years households from the best earnings quintile fundamentally make use of straight down fees, gaining on average more than $65,000. Working-ages households in the center of the funds shipping is actually mainly unaffected, with an average lifetime obtain from less than $500, because they face a go from needing paying apps having been smaller, as well as make use of a number of the tax slices. Clean energy organizations state the balance you will cripple its organizations by the removing out taxation subsidies and you may financing made available within the Biden administration.

Taxation to your Societal Protection Professionals

The newest regulations would make long lasting trillions away from bucks in the business tax incisions enacted in the 2017 through the Trump’s basic name and you can develop almost every other income tax holiday breaks for enterprises. Detailed with forever decreasing the business his explanation taxation speed in order to 21% regarding the 35% height before the 2017 taxation incisions. The balance could offer or improve almost every other income tax vacations to own business assets, such as those to the the newest machinery, devices and you can lookup and you can development, which company organizations said do prompt organization assets from the U.S.

- On the Snap, the newest megabill manage slice the nutrition direction system by the $230 billion, considering CBO prices.

- Other provisions create lose professionals to have users to buy digital car, residential solar panels and you can equipment making their houses much more energy-efficient.

- And, more recently, the newest CBO estimated the Senate form of the bill do trigger 11.8 million dropping health insurance in the 2034 – even though there try no dysfunction by sort of publicity forgotten.

Other signs tend to be bonsai woods, fortunate coins, and you may playing cards from 9 to Expert. The new Crazy try illustrated by Fantastic Dragons (shaped to create the amount 88), and also the Ying Yang acts as the newest Scatter. The new regulation yes don’t get a genius to work out, however, We’ll run-through him or her rapidly.

To own professionals who love to start by a small finances, minimal choice within game is £0.ten (GBP). The fresh advanced of the limit wager £fifty (GBP) is going to be attractive to own professionals unafraid from taking risks and seeking larger wins. The most enormous victory in almost any game try gaining potential limitation profits, the value of which to possess 88 Money are 20x. The betting feel might possibly be as well as fascinating because of game themes Far-eastern, Silver. The best international position on the July 8, 2025 was a student in Estonia, the spot where the games ranked #4044.

Nevertheless the nonpartisan Committee to possess a responsible Government Finances labeled the individuals “fantasy growth presumptions” one to “are numerous moments large” than the prices of other separate experts which have modeled models of your expenses. The brand new CRFB mentioned that modelers apart from the newest CEA provides estimated economic development in the range of 0.1% to a single.3% annually, promoting a reduced amount of a rise in get-home pay for family members. 88 Wealth offers amazing graphics, a good realistically conventional sound recording, and its own software to the any product is simply unbelievable.

Actually, this video game are slightly on the reduced-paying front, however, that doesn't mean which wouldn't reward lucky punters which place it out. As a result of two unique bonus signs, spinners is hope to enhance their balance to the larger profitable territory. Players must also observe that the game cannot provide the chance to get people grand wagers, with a total bet limit of 5.00 loans. Interestingly, however, the game does determine their complete choice inside a somewhat unorthodox means through the use of range bet choices – 0.01, 0.02, 0.03, 0.10, 0.20, 0.50 – in order to 5 shell out lines rather than one.

Trump’s Unfounded 68% Income tax Increase Warning

The brand new Federal Federation from Separate Team, a respected small company lobbying classification, acknowledged the new regulations for making permanent a different deduction to your owners of particular admission-due to entities who shell out organizations taxes on their private taxation statements. White Family spokeswoman Abigail Jackson performed, although not, let us know that the talking area shown the new feeling away from not “end fees to your info, overtime, and Social Defense,” as the advised in the expenses. And you may Trump states so it also incorporates the result away from not extending certain conditions on the 2017 Income tax Slices and you will Operate Operate that will be set to end this season. The brand new Senate statement comes with $4.5 trillion in the taxation incisions — extending the lower costs passed inside 2017 and you may incorporating the newest income tax slices. But Senate Republicans have chosen to take tips to get rid of said of the 2017 tax cuts inside the deciding the bill’s impact on the new deficit. Republican Sen. Costs Hagerty, who had been presiding along the Senate within the April, ruled one to Sen. Lindsey Graham, the fresh Senate Funds Panel chair, met with the only power to decide whether or not extending the newest 2017 income tax slices technically increases the deficit.

Household Minority Frontrunner Hakeem Jeffries argued throughout the an instantly reading one to it might "cause scores of People in the us to reduce healthcare and you will dinner direction." "There is nothing breathtaking in the stripping away people's health care, forcing infants to visit eager, doubting communities the fresh resources they require, and you can increasing impoverishment," the brand new York Democrat told you. Republicans is remembering the new slim Home passing of a great megabill in order to financing Chairman Donald Trump's domestic plan as the an earn to possess Americans. Democrats are slamming it as helping the fresh rich when you're injuring lowest-earnings somebody.

The brand new Senate bill manage go further than the earlier version enacted in the home by towering the new taxation penalties to your cinch and solar farm ideas already been once 2027, unless of course it met the needs. That could threaten vast amounts of bucks inside investment inside the clean energy ideas — as well as the 1000s of perform who come along with the individuals plans, in addition to inside Republican-added says such Georgia and you can Sc. A summer 7 memo in the White Family argued you to definitely Republicans in the Congress would definitely expand the new 2017 income tax incisions and you may “a genuine portrayal from current upcoming deficits adjusts to your extension” of your cuts.